China’s pesticide manufacturers have increased

their investment in the research and development of pesticides by more than 33%

in the first half of 2017. This development mirrors the trend in middle-income

countries.

The R&D development is a crucial factor

for China to meet the strict quality and safety requirements for food. It also

supports a better reputation of Chinese manufacturers to ensure the acceptance

in export markets. Both, the Chinese government as well as the domestic

manufacturers are fully aware of the importance of innovative pesticide development

and have increased their investment into the R&D segment significantly.

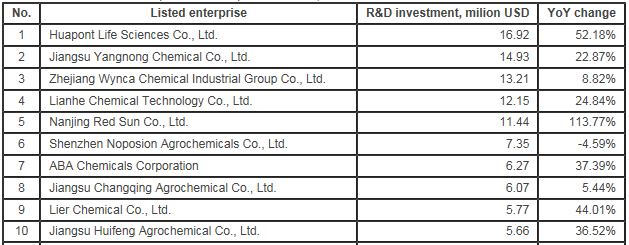

In H1 2017, the total R&D investment of

the 20 main listed pesticide enterprises in China hit USD122.54 million, up by

33.26% year on year. Among them, two recorded year-on-year drops in their

R&D investment. And the top three enterprises by R&D investment were

Huapont Life Sciences Co., Ltd., Jiangsu Yangnong Chemical Co., Ltd. and

Zhejiang Wynca Chemical Industrial Group Co., Ltd.

R&D Investments of 10 listed pesticide

enterprises in China, H1 2017

Source: CCM

Cost

development

According to a study by the European Crop

Protection Association states, that the costs for getting a new active

ingredient into the pesticides market was increasing sharply from about USD152

million in 1995 to USD286 million in 2014. The costs structure of the Research

can be divided into Chemistry and Biological Research, while the Development,

which builds the larger costs part, contains Chemistry, Field Trials,

Toxicology, Environmental Chemistry, and Registration.

It is notable, that on average, enterprises

need to research and synthesize about 160,000 products to get an average of 1.5

products developed and 1 product finally registered. Back in 1995, the number

researched products to get one registered product was low as 52,500. Also, the

number of years from the product discovery to the first sales has increased

from 8.3 in 1995 to 11.3 in 2014.

Shifting

R&D locations

During the past decades, the spending on

research and development has been shifting from high-income governments to

middle-income governments. This is a trend, that is actually occurring for the

first time since the modern agriculture establishment. Additionally, the public

spending on agricultural and agrochemical development is decreasing currently,

while the private-sector is catching up with the investing.

The increasing importance of private-sector

R&D globally reflects two different developments in the agriculture sector.

On the one hand, there is an impressive growth in R&D in crop genetics,

farm machinery, agricultural chemicals and food processing in several

middle-income countries. On the other hand, there is the offshoring of Agricultural

R&D to rapidly growing middle-income countries by multinational firms,

which are headquartered in the rich countries.

The company Bayer, for example, is investing

around 1 billion Euro every year for its research and development segments.

According to the executive management, the efforts are going to release 15 new pesticide products until the year 2020.

About CCM

CCM is the leading market intelligence provider for China's agriculture, chemicals, and life scinece market.

For more information on China's pesticides market, have a look at out Newsletters and Industrial Reports or directly join CCM's market intelligence database for access to many years of agrochemical market research.